Bullseye Investment

Group

Home of the American Ingenuity Portfolio

What We Do

Proprietary Research

The American Ingenuity Portfolio leverages a time tested process to spot high-potential opportunities.

Proven Results

The American Ingenuity Portfolio has outperformed the S&P Index 500 since inception.

Unique Access

The American Ingenuity Portfolio is available exclusively through Bullseye Investment Group.

Meet the Founder

Adam Johnson manages the American Ingenuity portfolio exclusively at Bullseye Investment Group. He is also the founder and author of the Bullseye Brief, a weekly investment letter focused growth opportunities for thoughtful long-term investors.

Previously he anchored several daily programs at Bloomberg Television, interviewing CEOs, heads of state, and prominent investors. Mr. Johnson appears weekly on FOX Business, participating as a regular panelist and portfolio manager.

During his three decade career on Wall Street, Mr. Johnson has traded stocks, options and oil for ING Asset Management, Louis Dreyfus and Merrill Lynch. He graduated from Princeton with a degree in economics.

He resides in New York City and enjoys cooking, skiing and shooting.

Unleash The Power Of Innovation With The American Ingenuity Portfolio

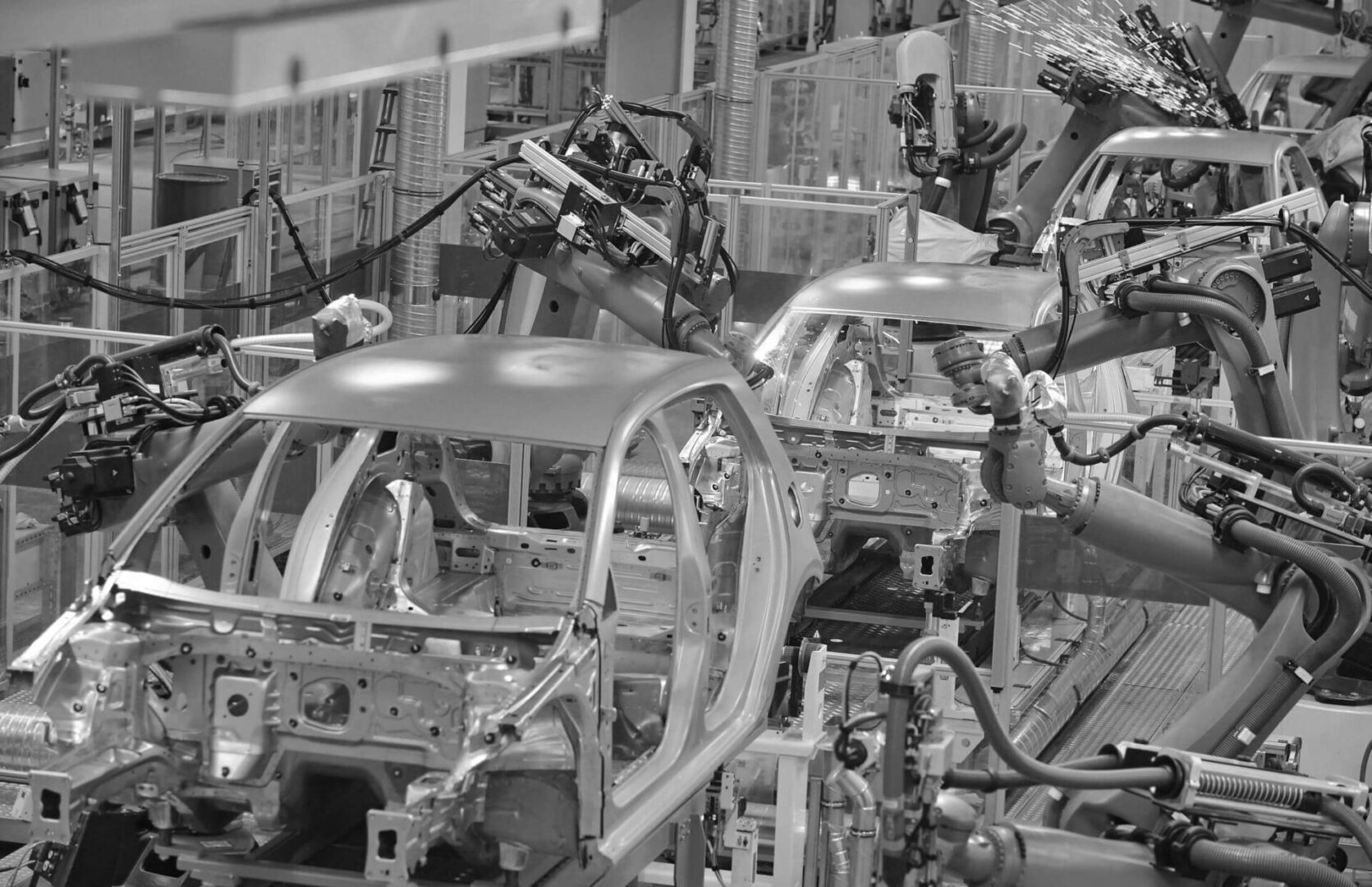

The American Ingenuity portfolio carefully curates 35-40 publicly-traded US equities with significant runway for growth. These are dynamic, US companies propelling the world forward across multiple industries. Focus sectors include Energy, Health Care, Industrials and Technology. The American Ingenuity Strategy thrives on adaptability, mirroring the agility of the companies it invests in.

Our meticulously crafted portfolio leverages proprietary research, identifying disruptive companies poised for long-term growth. New positions enter the fund based on individual merit, and each shares three defining attributes: Great story, Compelling data, Identifiable catalyst. Upside targets and downside alerts are determined in advance to manage risk/reward.

Bullseye Investment Group manages wealth for families globally on the Charles Schwab platform. Minimum investment is $500k and the annual fee is 1%. Since launching in 2016, Bullseye's American Ingenuity Portfolio has significantly outperformed the S&P 500 Index.

Bullseye Investment Group focuses on the people, companies and technologies driving the world forward. Our flagship American Ingenuity Portfolio curates 35-40 high-growth U.S. equities defined by compelling data and actionable catalysts. With a minimum investment of $500k and an annual fee of 1%, we offer a data-driven, dynamic approach that has consistently outperformed the S&P 500 Index since inception. Our success lies in our ability to anticipate market trends and strategically adapt, delivering results for investors who seek to maximize returns through informed decision-making.